Appropriately, it seems to be like like we’re right correct proper right here in a single completely totally different US election 12 months already.

As Superior Mustachians, we already know that the continued battle of Harris vs. Trump should not be consuming loads of our time. Constructive, we do our evaluation and cast our votes nonetheless after that we swap acceptable on to produce consideration to completely completely various factors inside our personal circle of control.

Nevertheless out of the entire components the politicians want to bicker about, there’s one area the place MMM does should set the file straight, and that area is in any case money. Your money, the monetary system primarily, and the overall wealth of the nation.

Politicians are already not acknowledged for being the sharpest items all via the shed in relation to technical stuff like science, know-how, or economics. Nevertheless this 12 months the discourse has flip into considerably dumb, as our candidates try to manipulate undecided voters in swing states with ideas which may be based utterly on irrational emotions fairly than sound monetary sense.

For one considerably humorous occasion, you may need seen that the competing social gathering (Trump on this case) is attacking the incumbents (Biden/Harris) over the “harmful monetary system.” When the very fact is the US monetary system is stronger than it has ever been, with the underside unemployment we’ve ever seen as appropriately.

It’s laborious to consider a better state of affairs than we have purchased acceptable now, and primarily the newest bout of higher inflation is a sign that components have been going too appropriately, and we’d have appreciated to step on the brakes with the help of higher interest rates.

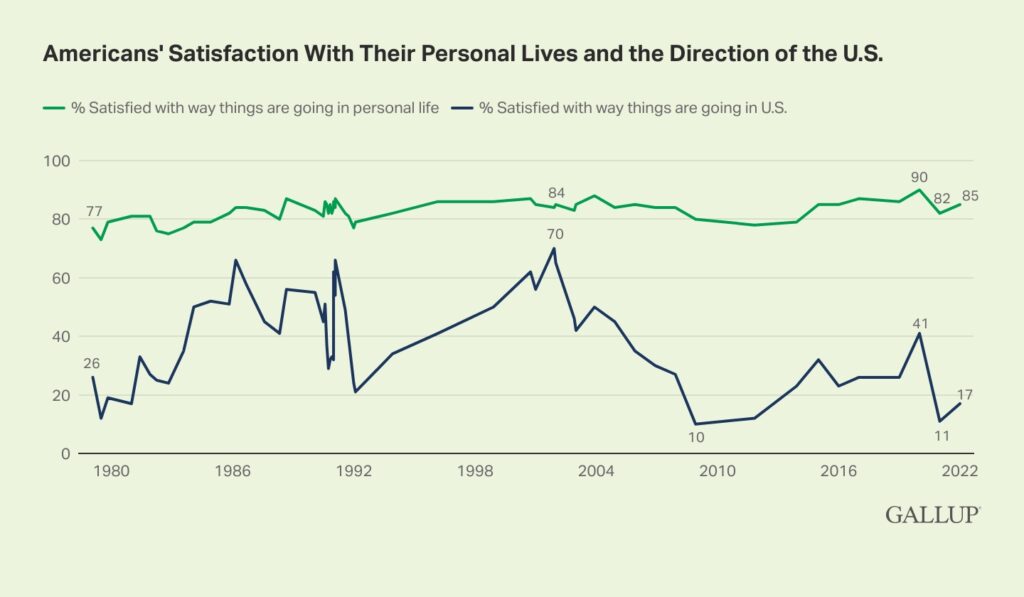

Nevertheless indirectly the mom and father nonetheless seem to think about that we have a “harmful” monetary system. Try this Gallup poll exhibiting that whereas most people (85%) are doing barely efficiently acceptable now, they assume that it’s merely their very personal luck – solely 17% consider the monetary system is doing appropriately.

That’s mathematically inconceivable, on account of if most people are doing appropriately, that’s the definition of monetary system! And suspiciously adequate, this widespread wrongness correlates pretty appropriately with the rise of social media misinformation.

So the politicians and the information have been doing the opposite of what they have to be doing in a very great state of affairs (sharing correct information). And constructive, we’re in a position to often merely ignore their speeches and go on with our lives. Nevertheless in relation to economics, data is vitality (and money). The additional exactly we understand how components truly work, the wealthier we’ll all flip into.

So with all that in ideas, I hereby present you with my file of the…

Prime Dumb Components Politicians Want You To Take into accounts About The Financial system

1: The President Controls the Financial system

If there’s a recession, the opposition social gathering likes accountable it on the current president. If the monetary system is booming, the current president likes to supply himself (or probably shortly herself) credit score rating score rating for all of that success. Nevertheless truly, the US monetary system is methodology too large – and thankfully methodology too free – for the president to deal with or truly even impression all that strongly.

Actually, our monetary system is a big machine which converts labor and provides into components like iPhones, hospitals and pumpkin pies. And although we’re an important monetary system at 26% of the planet, we’re nonetheless intently influenced by that fairly a lot larger 74% of economic apply that the totally completely totally different 7.6 billion of us on Earth are busy producing everywhere else.

After we’ve got obtained our inevitable little progress and bust cycles, they’re principally attributable to the standard cycle of irrational exuberance (and greed) much like the 2007 housing progress, adopted by transient intervals of most concern and pessimism much like the 2008-2012 financial and housing crash.

The federal authorities does play a course of too, by setting tax costs and totally completely totally different concepts. Nevertheless the outcomes of these insurance coverage protection safety insurance coverage protection insurance coverage insurance policies are sometimes so delayed and unpredictable, it’s possible you’ll’t draw a straight line between instantly’s president and instantly’s monetary system. In fairly just a few phrases, the federal authorities does its best to deal with the rudder on our massive ship, nonetheless all via the momentary time interval our monetary system lurches spherical on the waves and storms of the ocean.

2: The President Controls Curiosity Costs

This one may be very humorous to me, as our candidates feign sympathy for the laborious lifetime of coronary coronary heart class People, who now face elevated borrowing costs on their financial institution collaborating in taking part in playing cards and automotive loans and mortgages. They declare they’ll battle to ship the prices of curiosity down. Trump even goes as far as bullying our Federal Reserve board members (who can solely do their jobs if we allow them to carry out as unbiased specialists) and suggesting that he would take over all the division, if elected.

The precise story is that whereas monetary security may presumably be a horrible machine to go away all via the arms of a sitting president (see Argentina), it does carry out as a horny set of gasoline and brake pedals for the monetary system if used appropriately. When components decelerate and unemployment will get too extreme, a cut back to the prices of curiosity will produce a elevate in all of the factors from new jobs to stock prices. Nonetheless when components get too scorching, you get quick inflation which could mess up the system.

3: Inflation has Made Life Additional sturdy for People (and the President Can Magically Reverse it)

This line of reasoning is even dumber than the final phrase one. For numerous years after the Covid interval, we had quick inflation. It was attributable to a bizarre combination of a gadgets shortage attributable to components like manufacturing unit closures and distant work, plentiful demand from authorities stimulus spending and low prices of curiosity. These components have since ironed themselves out, and inflation is as quickly as additional all one of the best ways whereby all one of the best ways proper right down to an ultra-low 2.4%.

Nevertheless most significantly, wages have nonetheless risen faster than inflation so we’re all higher off than earlier than! Since 2019, common prices are up 19% and our wages are up 21%. So even in any case that inflation, we’re nonetheless doing merely unbelievable. Nevertheless the candidates are nonetheless bickering over inflation as if it’s a exact draw once more, and even worse promising to “ship prices as quickly as additional down”. They normally’ve managed to have an effect on the voters that “elevated wages and prices” is comparable state of affairs as “a foul monetary system”. Which is solely plain fallacious.

Bonus dumbness: politicians moreover normally blame “greedy firms” for rising prices to hoard revenue. Whereas value will enhance are utterly acceptable in a market system (as a enterprise proprietor you might be free to set prices wherever you need), truly it doesn’t normally happen on account of our markets are too aggressive. For instance, a recent deep analysis from NPR confirmed that no, grocery retailers haven’t made any windfall earnings in the least off of this newest bout of Covid-fueled inflation.

4: The President Controls Housing Prices

One important state of affairs that has modified over the earlier ten years is that US dwelling prices and rents have every risen fairly a lot faster than frequent inflation and even wages. On the optimistic facet, prices of curiosity have moreover risen which tends to make houses really truly actually really feel costlier and is supposed to help ship dwelling prices down. Nonetheless it hasn’t occurred nonetheless which suggests we have purchased the double whammy of higher prices and elevated curiosity costs for mortgage debtors.

The dumb half is that our candidates are proposing components which will make the problem even worse, like subsidies for first-time homebuyers or schemes to cut once more the prices of curiosity. When truly the reply is to improve the availability of housing, which I personally assume will happen if we stop inserting up roadblocks for homebuilders (myself included) to assemble housing.

Components like faster and cheaper permits, a lot lots a lot much less onerous and costly establishing codes, eliminating suburban-style zoning and setback and automotive parking concepts, and altering authorised concepts so that NIMBYs not get any say over what totally completely totally different of us do with their very personal land may all help within the discount of the value of building a house by about 50%, shortly and utterly.

5: The President Controls Gasoline Prices, and They Are At current “Extreme” and We Want Them Lower

Ahh, gasoline! Greater than doubtless most certainly most likely probably the most ridiculous of things to stress about and the gasoline for loads of of MMM’s rants since 2011.

To start out with, on an inflation-adjusted basis, gasoline continues to be about the same price due to it was in 1950: all via the $3-4 fluctuate per gallon, in instantly’s {{{{dollars}}}}.

Secondly, it is so low value that even with our monumental inefficient American autos, the frequently household continues to be solely spending 2.5% of their disposable earnings on the stuff! (The humorous half is that they spend many situations additional on the rest of the auto possession experience whereas contemplating gasoline is the half that is expensive)

Third, gasoline has been outdated for nearly a decade now. You might get a used electrical automotive for a lot lots a lot much less than the value of a comparable used gasoline automotive, or while you’re a fancypants money waster like me, new EVs are moreover cheaper than their gasoline counterparts. You get a faster, nicer car that almost truly not needs repairs OR gasoline, and cut back your funds.

So why are we even nonetheless talking about this conventional gasoline of a historic events? Why aren’t the candidates moreover arguing over the value of Kodak film or typewriters or fax machines?

6: The Financial system is One concern We Ought to Even Concern About

The funniest half about all this monetary think about is that we’re specializing contained in the fallacious state of affairs. Whereas laborious work and enterprise and advancing the frontiers of human data are all good components, the very fact is that we handed the aim of getting “Ample” plenty of years beforehand. When the American coronary coronary heart class complains about how laborious we have purchased it as of late, it’s like a bunch of overfed of us at a buffet wishing they may merely have nevertheless one different mannequin of donuts stacked onto the desk.

Positive, we have purchased earnings and wealth inequality so that the rich normally are inclined to get richer additional shortly. And optimistic, we should all the time frequently defend that in try with a significantly progressive tax system on account of an additional equal society tends to be an additional peaceful and utterly happy one.

Nevertheless have you ever ever ever ever seen that due to the rich of us get richer, they don’t get any happier? It’s on account of after you go the aim of “Ample”, together with more money doesn’t truly help fairly a lot.

And “Ample” is way further outlined by your mindset (and your assortment of life experience) than your paycheck. So if the politicians truly cared about bettering our happiness and wellbeing, they’d be preaching the Ideas of Mustachianism fairly than pandering to the exact requests of coal miners or billionaires.

Nevertheless alas, worthwhile an election is a very utterly totally completely totally different state of affairs than proposing stuff that is really best for the nation. And for that carry out, we cast our votes for the proper social gathering after which tune as quickly as additional out until the subsequent election.

Utterly happy voting!

All via the Options: Has the election season been getting you down, pumping you up, or just offering you with an intensive dose of “Meh”?

Further Learning/Watching:

Whereas researching monetary stats for this textual content material materials, I obtained correct proper right here all by a peculiar nonetheless informative sequence of flicks usually referred to as USA Facts by none aside from former Microsoft CEO Steve Ballmer. Evidently evidently he had the identical frustration as me: Individuals are combating over a bunch of opinions and misinformation with out even bothering to hunt for the exact particulars. So he made a well-produced sequence of flicks that merely share the small print with out the baggage of political hype on excessive of them. I’d love our legislators may do the identical state of affairs!

Bonus Podcast based utterly on this textual content material materials!

As a result of magic of AI, it’s possible you’ll direct the wizardry inside Google to generate a custom-made podcast on virtually one issue on the Net. A reader merely emailed me this address this episode – remarkably human-like and even entertaining!

https://notebooklm.google.com/notebook/0e1d0af8-8888-466c-abe4-8b1da8986773/audio